洞见机遇

赢领未来

DEMO SAMPLE - Outdoor Destinations | Fashion to Farm | Ne Zha 2

Jump to section

China Macro: Economy, Government, Society

宏

Overview of any government movements affecting end consumers and brands.

OPINION: China to Develop High-Quality Outdoor Sports Destinations

China is set to establish a network of high-quality outdoor sports destinations and supporting infrastructure by 2027, aiming to drive industry growth, boost regional economies and promote national fitness levels.

The strategy leverages regional advantages to tailor sports offerings: ice and snow sports will be prioritised in North China, where colder climates extend the snow season; East and South China, with their rivers and coastlines, will focus on water activities; and the mountainous landscapes of the Northwest and Southwest will support activities like rock climbing, canyoning and rafting.

Beyond sports facilities, the plan includes comprehensive infrastructure improvements—enhanced public transport, parking, restrooms, changing rooms, medical centres, professional coaching, insurance services and the expansion of competitive events such as tournaments and championships.

Hot Pot Takeaway

- Capitalise on China’s booming sports market: Sales in the sports and outdoor category grew 17% to $35 billion in 2024, with government investment further accelerating expansion.

- Adopt a regional strategy: Move beyond Shanghai and Beijing—China’s diverse geography shapes sports preferences. Tailoring campaigns to different regions can unlock major growth, especially for niche sports brands.

- Leverage travel and activity-driven demand: Target key locations for seasonal and destination-based marketing. As a reference point look to Canada Gooses’ growth strategy in China, where having landed meaningfully in Beijing and Shanghai, retail expansion rapidly took in the winter travel and sports hub of Harbin.

- Tap into specialisation and niche sports: The next wave of growth will come from specific, passion-driven sports communities—offering new entry points for brands in China.

NEWS: Shanghai Launches Short Video Series to Explain Local Policies

The Shanghai Municipal People's Government General Office has introduced a new ‘Policy Public Lecture’ series—short videos featuring officials, journalists and academics explaining key policies that impact businesses and the public. Each video includes bilingual subtitles to ensure accessibility for both Chinese and English-speaking audiences.

One highlighted policy is the newly introduced ‘inspection code’ which government officials present during on-site business inspections.

Video via Shanghai government website

The code provides detailed information on inspection tasks, specific items under review, and the officer responsible. This initiative enhances transparency, streamlines the inspection process and allows businesses to leave feedback, reducing redundant checks and miscommunication between departments.

By incorporating English subtitles, the Shanghai government signals its commitment to breaking language barriers and better engaging the city's growing international community. This initiative reflects broader efforts to create a more business-friendly and globally connected environment.

Trend Tracker: Consumer & Social Insights

潮

An in-depth look at the latest consumption trends, social media movements and cultural shifts in China.

OPINION: New Livestreaming Trend: Idolising Livestreamers

A new trend called Tuanbo 团播, or group livestreaming, is gaining traction on Douyin.

Tuanbo typically features multiple livestreamers resembling pop idols who dance to music, while a main host in the background interacts with viewers, encouraging them to send virtual gifts or vote for their favourite performer.

Video via Douyin

This trend highlights two key insights about China's digital landscape: the enduring popularity of pop culture and the strong demand for emotional connections.

Unlike traditional pop idols, livestreamers offer an interactive experience—viewers can enjoy their performances while receiving real-time engagement. Even small gifts earn a livestreamer’s gratitude, often expressed on-air or through personal messages, fostering an ongoing digital relationship. Some livestreamers maintain these connections by sending regular messages, creating a sense of companionship.

This trend emerged after China banned idol competition shows like Idol Producer 偶像练习生 and Produce Camp 创造营 in 2021 and cracked down on excessive fan spending culture. Group livestreams now fill the void, allowing audiences to watch performers evolve from unknown talents to influencers—or even celebrities—while forming closer, more personal connections than they could with traditional pop idols.

Hot Pot Takeaway

- High-quality livestream production: Livestreams in China are competitive. High-production livestreams can resemble full-scale stadium events, complete with professional lighting, special effects, and multiple camera angles. The industry is highly lucrative—top-performing livestream studios can generate up to RMB 100 million per month.

- Leverage parasocial relationships: Tap into the emotional connection and needs of consumers. Livestream viewers spend money not just for interaction but for simple recognition, like a thank-you message, to drive engagement.

- Fulfil the demand for emotional validation: Understand the growing need for emotional validation in digital entertainment and create opportunities for consumers to feel acknowledged and appreciated.

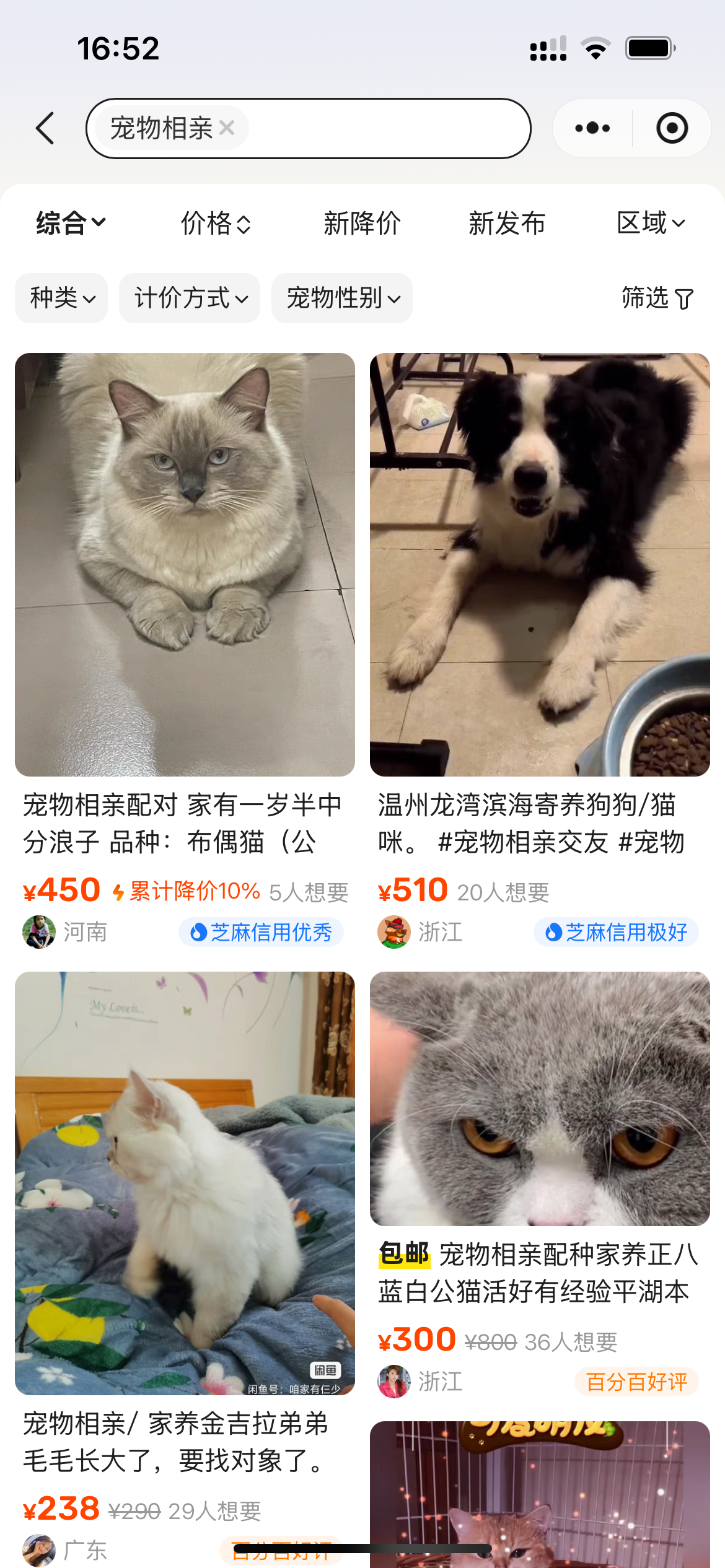

NEWS: Matchmaking for Pets

China’s pet industry has been growing rapidly, and a new trend is emerging—helping pets find their perfect match.

On the second-hand shopping platform Xianyu, an average of 3 million users actively search for partners for their pets. A personalised matchmaking package on the platform is available for RMB 800 ($110). In China, pet owners often place significant importance on breed, making it a key factor when selecting a match for their pets.

Beyond online platforms, pet shops and owners are also organising events and activities to help pets meet their ideal companions, with some even holding marriage ceremonies and issuing certificates.

This rise in pet-focused services has also fuelled other niche businesses. For example, iBabyGO 爱宠游 is an app designed to help pet owners travel with their pets. Given that domestic flights in China can take several hours, companies like this offer exclusive pet-friendly flights where all seats are booked, allowing every passenger to bring their pet on board.

New Global Entrants

新

Highlighting exciting global brands and concepts that have entered/innovated and are making waves in the industry.

Manolo Blahnik Launches on Tmall

British luxury shoe brand Manolo Blahnik has officially launched its first online shop in China via Tmall, following the opening of its first mainland China boutique in November 2024 at Shanghai’s Plaza 66 shopping mall.

The brand previously went through a 22-year trademark dispute and now it is making a comeback in the China market - however, the market has changed a lot in the intervening years.

A screen recording of the Tmall shop on mobile. The mobile version appears significantly more premium and polished than the desktop site, aligning with Chinese consumer habits, where mobile app shopping is the mainstream.

Hot Pot’s exclusive ecommerce data shows a sharp decline in the luxury footwear market in 2024. Net sales for female footwear priced above £525/RMB 4,900 (Manolo Blahnik entry-level) on Tmall dropped 35% to RMB 380 million, signaling a tougher landscape for luxury brands.

To stay competitive, brands must prove their value and offer fresh, personalised products—Chinese consumers are no longer drawn solely by brand heritage.

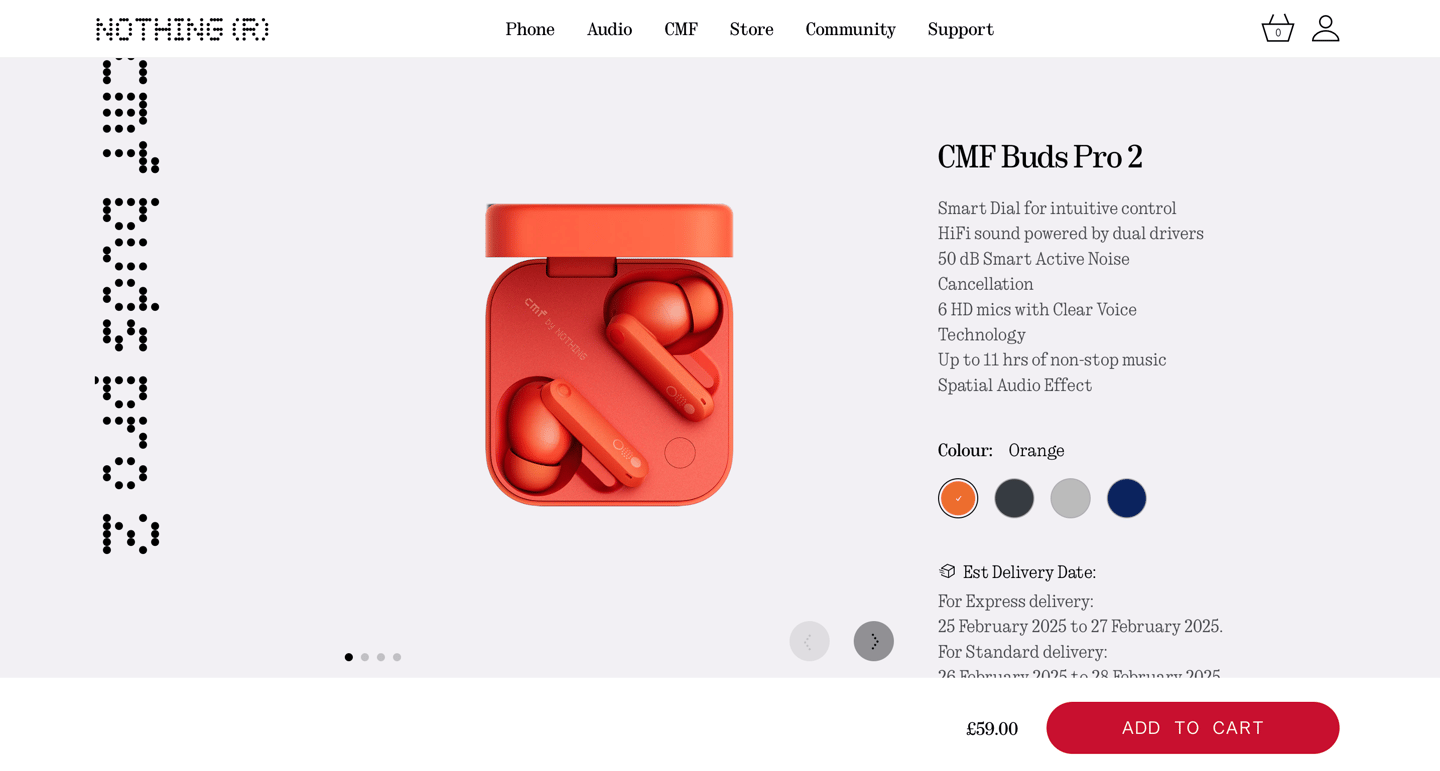

Nothing Announces Plans to Enter China in 2025

Electronics manufacturer Nothing is set to bring its earphones and smartwatches to the Chinese market this year.

However, given China’s highly competitive smartphone industry, the Nothing Phone will not be included in the initial rollout.

British smartphone brands have historically struggled in China. But it’s worth noting that while Nothing was founded in London, its origins trace back to its Chinese founders—now bringing the brand back to the market.

Ethiopia Sells Local Produce on Chinese Ecommerce Platforms

The nation of Ethiopia has introduced its Coffee Carver brand to China, selling single-origin Ethiopian coffee beans on major ecommerce platforms, including Douyin and JD.com.

The shops are operated by Grand World Group 大广天下投资控股集团有限公司, a Chinese company that is also reportedly exploring the sale of other Ethiopian produce, such as sesame and avocado. This initiative marks a deeper economic collaboration between the two countries.

Global Game-Changers: Innovative Products & Marketing Campaigns

创

Exploring groundbreaking marketing strategies from global brands that capture consumer attention and drive industry trends.

OPINION: Head & Shoulders ‘Rents’ Shoulders in Creative Campaign

To strengthen its brand association and reinforce its original English name, Head & Shoulders launched a creative campaign in China centred around the idea of ‘renting’ shoulders.

The campaign featured two engaging videos. The first played on the simple yet powerful gesture of resting one’s head on another’s shoulder—an act that evokes comfort, support, trust and emotional connection. By showcasing various scenarios, from couples and friends to family members, the brand positioned itself as the provider of clean, dependable shoulders for life’s everyday moments.

The second video took the concept further with a 10-minute mockumentary following a man who rents out his shoulders for people to rest on. Seamlessly woven into the storyline, Head & Shoulders appears as a brand that helps him maintain a "clean and reliable shoulder" for his customers. The video was so convincing that some viewers even questioned if the service was genuinely available.

Both videos via Head & Shoulders

Hot Pot Takeaway

- Deeply understand your target audience: Go beyond demographics by immersing yourself in consumers’ daily lives to create messaging that’s relatable and authentic, just like Head & Shoulders did with its portrayal of everyday struggles.

- Define your brand’s true role: Identify the deeper emotional connection your product has with consumers. Head & Shoulders isn't just selling shampoo—it’s selling respectability. Similarly, luxury handbags are symbols of status and running shoes represent commitment.

- Create bold, standout content: Don’t just follow trends—be bold in your approach. Head & Shoulders took a risk with a 10-minute ad in a short-form content world, and it paid off. Focus on telling stories that resonate deeply, not just quickly.

NEWS: Freitag Hosts DIY Event in Quanzhou

Swiss sustainable bag and accessories brand Freitag recently hosted a campaign in the UNESCO World Heritage city of Quanzhou, offering around 50 upcycled tarps for participants to choose from and create their own bags.

The event also featured a workshop led by local artist Jeje, repurposing fishing nets into pouch bags. The event also invited participants to watch a live performance of the traditional musical art form Nanyin 南音, further connecting participants with local culture.

The event was set in Chizi Kongjian 赤子空间, a multidisciplinary creative space converted from a former ice warehouse in the small coastal town of Xiangzhi 祥芝.

This space — Freitag’s first retail partner in Fujian — blends a bookshop, cafe, retail zone and exhibition areas and perfectly reflects the brand’s commitment to sustainability and industrial design.

Chinese Innovators: Products & Marketing Campaigns

赢

Showcasing the most exciting campaigns from Chinese brands that redefine the market and resonate with local consumers.

OPINION: AnKoRau Takes Its 2025AW Show to the Countryside

Athleisure wear brand AnKoRau 安高若 hosted its 2025AW show on its mother brand Zuczug’s farm in the outskirts of Shanghai.

The setting brought the brand closer to nature, perfectly aligning with its message of embracing the outdoors and staying active.

Rather than featuring mega influencers, the event invited models who are deeply connected to the brand’s community—outdoor enthusiasts, musicians and artists—reinforcing AnKoRau’s vision of international universality.

The show also reflects China’s evolving attitude towards the countryside. As the country continues to invest in rural development, new opportunities are emerging at the intersection of fashion, outdoor lifestyles and suburban culture, bridging the gap between trendsetters and regional landscapes, premium aesthetics and nature.

Hot Pot Takeaway

- Shift focus from product functions to lifestyle: Showcasing real-life consumption scenarios allows consumers to visualise themselves using the product and create an immersive experience that resonates with their daily lives.

- Leverage diverse, niche communities: Look beyond celebrities or mega-influencers, and work with representative individuals from different industries and backgrounds whose values align with your brand. These micro-influencers often have a more engaged and relevant audience.

- Measure social differently: Platforms like rednote (Xiaohongshu) have been particularly effective in driving engagement and awareness, where success isn’t just measured by sheer impressions or engagement numbers but by how well a brand can create a compelling consumption scenario and encourage user-generated content.

NEWS: A New Beauty Sector: Outdoor Beauty Products

As outdoor activities and fitness continue to grow in popularity, a new category of beauty products tailored for outdoor scenarios is emerging.

Brands like Sposh 似泊 and Blank Me are leading the way, catering to consumers who want to stay active while looking fresh and protecting their skin.

Sports and fitness are no longer just about training and sweating—it’s also about self-expression, confidence and socialising. On rednote, searches for ‘sports makeup’ 运动美妆 generate tens of thousands of posts, reflecting a rising demand.

These products are designed to address specific concerns such as sweat resistance, redness, dehydration, long-lasting wear and sun protection, helping people stay active while maintaining their best look.

Ecommerce Insights: Platform Strategies & Success

购

Deep dive into eccommerce performance, interpreting platform strategies and highlighting winning brands and products.

Continued Growth in China’s Fashion Ecommerce

The fashion category saw a strong start to the year across Tmall, JD.com and Douyin, with 7% overall growth in January 2025 compared to the same period in 2024, reaching $8.6 billion in net sales.

Key category performance:

- Clothing & Accessories: 6% growth – $6 billion (70% share, +3% vs FY 2024)

- Bags & Footwear: 9% growth – $1.2 billion

- Glasses & Jewellery: 8% growth – $1.3 billion

This growth aligns with Chinese New Year spending habits, as consumers traditionally invest in new outfits for the festive season. The transition from the Year of the Dragon to the Year of the Snake took place in late January, further driving sales.

Top-selling brands and products:

- Best-selling product: Women’s down jackets, led by Bosideng, which sold $101 million worth in January.

- Top-performing brand: Bosideng, with $157 million in net sales across clothing & accessories.

- Best-selling international brand: Uniqlo, ranking 4th overall with $79 million in net sales (+96% YoY). The brand also saw $7 million in women’s down jacket sales (+48% YoY).

Notably, 36% of net sales in the clothing & accessories category came from products priced above $55, suggesting that many consumers are willing to spend more on premium, high-quality products.

China Entertainment

娱

A look at pop culture, music, film & TV, celebrity and arts in China.

OPINION: Ne Zha 2 Becomes China’s Highest-Grossing Animated Film

Ne Zha 2 哪吒之魔童闹海 has made history, grossing over RMB 10 billion ($1.4 bn) at the Chinese box office, making it the country’s highest-grossing animated film of all time.

The 2025 animated fantasy adventure film, written and directed by Jiaozi, is a sequel to the 2019 hit Ne Zha. Released in cinemas across China on 29 January, the film has captivated audiences with its upgraded special effects and a more refined, attention-grabbing storyline that has been six years in the making.

To build anticipation, the production team strategically released behind-the-scenes content, including voice acting clips, to pique audience interest and encourage cinema visits. The film’s strong character development and relatable life stories have kept discussions alive long after its release, sparking fan-generated content, from cosplay to viral online recreations.

The success of Ne Zha 2 reflects the rise of Chinese animation and the growing demand for high-quality content. It also highlights a key trend: audiences are returning to cinemas, particularly during holiday periods, but only truly outstanding films can drive them to do so.

Hot Pot Takeaway

- Time campaigns for peak periods: Track key holidays, including digital events like 520 China’s digital Valentine's Day, to align your launches with consumer surges.

- Craft empowering messages: Focus on themes that resonate with the target audience, such as what’s conveyed in the film - personal choice and freedom, attracting younger, ambitious audiences seeking autonomy.

- Build a holistic campaign: Ensure your marketing spans pre, during, and post-launch, across both online and offline channels for maximum impact.

- Meet high expectations: Deliver on your promises—whether it's product quality or messaging—to maintain trust and satisfaction.

NEWS: Eggy Party Captivates Gamers Across All Ages

Over the past month, some of the fastest-growing gaming livestreamers on social media have been featuring Eggy Party, the hit mobile game by NetEase.

Originally launched in 2022, the game has gained a massive following, attracting players ranging from primary school children to young adults. Its appeal lies in its high level of freedom and strong social interaction features, allowing players to chat, form communities and even build relationships within the game.

Beyond showcasing gameplay tricks, content creators have started collaborating with fellow livestreamers, particularly those they connect with in the game. This has led to the formation of a network of Eggy Party streamers, making their content more engaging via real-time interactions.

As a result, audiences are not only drawn to the game itself but also to the evolving storylines and relationships between livestreamers, keeping viewers engaged and invested in following their content.

Video Opinion: Industry Voices

声

Featuring an interview series—either from the Hot Pot China team, network, client representatives, partners or consumers.

China’s Fastest-Growing Categories—Where Brands Should Focus Next

For this month's Industry Voices, we spoke with Davy Huang, Business Development Manager at JD Worldwide, about the fastest-growing categories in China and what brands should watch in 2025.

JD is China's second-largest cross-border ecommerce platform.

Hot Pot Takeaway

As we wrote in the December edition, 3C digital and electronic appliances are experiencing double-digit online growth, largely driven by China’s state subsidy program. Brands like Xiaomi, Huawei, Oppo, and Insta360, as well as international names like Fujifilm, GoPro, and Panasonic, are seeing strong momentum.

Gaming consoles continue to grow year over year, with portable devices leading the charge—Nintendo, Microsoft Xbox, Sony PlayStation, and Steam Deck are key players in this space.

Meanwhile, the fashion industry, particularly outdoor and activewear, is thriving. Brands like Lululemon, Moncler, Vuori, Kolon Sport, and Montbell have made significant inroads, and Alo Yoga is preparing for market entry. Chinese brand KAILAS is also gaining attention.

This growth is fueled by a shift in consumer mindset—from focusing purely on function to seeking added value. Many are making purchases as a form of self-reward, a trend especially prevalent among female consumers and high-income males. There’s also a growing demand for products with professional-level features, as consumers move beyond entry-level offerings.

To succeed in China, brands need a clear and decisive strategy across social, digital, and sales channels. Investing in brand equity, strengthening consumer relationships, and improving sales efficiency are all crucial. A seamless online and offline presence is key, as is balancing DTC and distribution models to ensure effective market penetration.

Login or Subscribe to continue reading

Subscribe to the China Playbook for a monthly dose of fact-driven information from China, broken down and explained by thought leaders here at Hot Pot China. As a member, you’ll unlock unlimited access to data, actionable insights and strategic takeaways you won’t find anywhere else.